Partial Pay Installment Agreement

A Partial Payment Installment Agreement (“PPIA”) allows you to pay off your tax debt for less than the total amount you owe. This agreement puts you on a monthly set amount payment, which then ceases as of the Collection Statute Expiration Date (“CSED”). Once the CSED has occurred, any tax balances tied to this date are not collectible, and the IRS dismisses any remaining portion of the balance owed.

A PPIA will reduce tax debt and afford you a set monthly payment plan. A PPIA can save money; however, it is a complicated process involving strict criteria for qualification.

Are you considering if this option is right for you? Would you like to see if you qualify for this payment plan? Will Harmon, tax attorney-CPA-IRS EA of Harmon Tax Resolution, LLC, can help you decide if a PPIA is ideal for your situation. And if so, he can guide you through the application process. Here’s the critical information.

What Is a Partial Payment Installment Agreement?

Under a Partial Payment Installment Agreement (“PPIA”), the taxpayer makes monthly payments towards the tax debt up until the Collection Statute Expiration Date (“CSED”), which ordinally, the CSED period is for ten years after the date the tax was assessed. The CSED limits the time frame the IRS can collect on the debt. A PPIA creates a payment plan which ends when the CSED ends. The IRS then removes any remaining applicable tax balance.

How Partial Payment Plan Installment Agreements Work

Here’s an example: Hypothetically, a taxpayer owes $30,000. They can only afford to pay $200 monthly, and the collection statute expires in four years. They will make the $200 monthly payments for 48 months if they qualify based on their situation. At that point, the CSED expires, and even though the taxpayer has only paid $9,600, they won’t owe any additional money. In essence, they cut $20,400 off their tax bill.

PPIA seems ideal for those who qualify; however, there are stipulations with the plan one should consider. With PPIAs, the IRS reviews the taxpayer’s financial situation every two years. In the proceeding example, the IRS investigated the taxpayer’s finances after the first 24 payments. The IRS concluded that the taxpayer was earning sufficiently more money where the taxpayer could afford $500. Based on their new income determination, the IRS can increase the monthly payments to $500/month for the last two years of the plan. Therefore, it’s essential to consider what possible changes may occur throughout the life of the PPIA period.

In addition to income and expenses, the IRS also factors in your equity situation. Let’s say that when the IRS looks over your situation and discovers that you inherited an additional property home from a relative, the IRS can demand that you borrow against this home or sell it and use the proceeds to pay off some or all the tax debt. The ability of the IRS to enforce against acquired equity is a crucial concern to the partial payment installment agreements.

Should I Enroll in a Partial Payment Installment Agreement?

You should consider this program if you cannot afford to pay your tax debt under a payment plan before that Collection Statute Expiration Date. Here are some other indicators which may indicate that you should apply:

- You are unable to pay your tax bill in full.

- You don’t have any assets or equity in them to sell or borrow from to pay your tax debt in full.

- You are unable to acquire a loan to pay off your tax debt.

- The traditional IRS Installment Agreement monthly payment is unaffordable.

- Your IRS Offer-In-Compromise proposal was rejected.

- You cannot obtain Currently Not Collectible status or qualify for hardship status.

The PPIA is ideal for people who can’t afford to pay their tax debt in total but at the same time are unable to qualify for hardship status. The PPIA falls between these options; however, strict criteria must be met to qualify. Talking to a qualified tax attorney-CPA will guide you on whether this is the right option.

Partial Payment Installment Agreement Requirements

Here are the qualifications for this plan:

- The tax Balance owed must be at least $10,000

- Establish that you don’t have assets that could be sold to pay the tax debt.

- Show that you cannot afford monthly payments under a base IRS Installment Agreement.

- The tax debt under consideration was not covered under a previously approved IRS Offer-In-Compromise (“OIC”). Once the tax debt is approved under OIC, you cannot opt out of the Partial

- You are currently not in bankruptcy.

- You must comply with tax filing requirements, federal tax deposits, and estimated tax payments.

The IRS will review your financial situation every two years during your PPIA. If your finances change, the IRS may require a larger monthly payment, or you must pay off the balance in full.

Ideally, if you are approved, it is recommended that you agree to set up a monthly direct debit payment from your checking account or even have payments taken directly from your paycheck.

How to Apply for a Partial Payment Installment Agreement

The IRS requires you to provide complete and in-depth information to establish your qualification for approval for PPIA. This information is completed on several forms: IRS Form 9465 (Installment Agreement Request), IRS Form 433A (Collection Information Statement for Wage Earners and Self-Employed Individuals), or 433B (Collection Information Statement for Businesses). This form will report all your assets, liabilities, income, and expenses. Some expense items may be subject to IRS limitations. However, there may be justification, which, if adequately advocated for, may allow certain overages to be accepted by the IRS. A tax attorney-CPA could help tremendously secure the best agreement possible with the IRS.

What the IRS Uses to Determine Your Monthly Payment

The IRS representative will review the application and may request additional information. The amount of the tax debt will often determine the level and depth of inquiry. The IRS representative may request information not listed within the typical IRS request forms or even inquire about income or expense fluctuations of 20% or more.

The IRS goes through financials to determine your equity component. They then decide whether certain assets should be sold or loans should be made against them. After this, the IRS calculates your monthly payment to be made.

The monthly determination is based on strict adherence to IRS expense standards, determining how much you can afford. The IRS standards will determine how much of your excess income will be used in the payment calculation. The standards are based on detailed guidelines that assign expense criteria to the national and regional standards. Certain expenses will fall under one of these types. IRS is very strict with its standards applications.

For example, suppose your car or housing payment amount exceeds the IRS standard listings. In that case, the IRS will only allow you to use amounts up to the standard, not excess, when determining allowable expenses. Many of your basic expenses will fall under the IRS guidelines. The IRS is very inflexible with allowances outside of its guidelines. This is an excellent reason to have a knowledgeable tax attorney-CPA working with you to ensure the IRS adheres to the greatest allowances possible in your case.

If it turns out that your allowable financial listings result in an inability to pay at least $25 a month payment, you may want to see if you qualify for hardship status. If you are eligible, the IRS will cease collection until the statute expires or your financial situation changes before the collection expiration date.

What to Consider if the IRS Calls for Selling Assets within the Partial Payment Installment Agreement

The IRS may require you to sell assets or take a loan against them to cover part of your tax liability. For example, if your tax debt is $25,000 and you have a brand-new boat, you’ll probably be required to sell it or take a loan. Only a very minimal amount of assets is excluded from this regulation.

There may be some situations that allow you to avoid selling your assets or borrowing against them:

- The assets have minimal equity.

- There is no market to sell the asset to.

- Unable to obtain an equity loan from a creditor

- Co-ownership of the asset by a spouse who is not liable for tax debt and is unwilling to take a loan out on the asset.

- The asset is required for income generation needed for the PPIA plan.

- You would suffer severe economic hardship from selling the asset.

It would be prudent to consult with a tax attorney-CPA if you plan on selling your assets to help ensure you’re making the best choice and negotiating ideally with the IRS.

Make Sure to Consider All of Your Options

There may be other options that would better resolve your tax situation. Partial Pay Installment Agreement (PPIA) vs. Offer in Compromise (OIC) A PPIA and an OIC allow you to settle your tax debt for a lower amount than you owe. In either case, the IRS will agree to pay your tax debt for less than you owe. After completing all the terms of either program, the tax debt is gone permanently.

Additionally, either program has strict application criteria and completes comprehensive, detailed personal/business financial 433 forms. The approval rates are not high for either program. If you want to get approved for either of these programs, you should consider working with a tax attorney-CPA.

Bear in mind there are significant differences between a Partial Pay Installment Agreement and an Offer In Compromise, which are essential to consider. Here they are:

Time Frame of Payments

An Offer In Compromise – Inability to Pay requires you to pay the offer in a lump sum or monthly payments over 24 months. With a PPIA, you make payments until the collection statute expires. The time could vary from a couple of years to many years.

Understand Your Financial Situation

When you get an offer in compromise, you must comply with tax filing and payment obligations for five years. For instance, you must file your returns and make your estimated quarterly tax payments if required. If you don’t, the IRS can rescind your offer and demand full payment of the tax debt. However, the IRS can’t take away the offer with an OIC if your financial situation changes.

In contrast, if you have a PPIA, the IRS reviews your case every two years, and you may have to pay the entire tax liability if your situation improves. A PPIA might save you money in the long run if your financial situation is stable. Still, if you believe your financial situation will improve during the tax statute expiration time frame, OIC may be better for you. It’s crucial to under your financial situation presently and in the future as well as possible when determining which plan may work best.

Approval Rates

Generally, the IRS tends to approve Partial Payment Installment requests at higher rates than OICs. OICs, on average, only get approved 33% of the time. When you talk with a tax professional, they will know which programs you’re likely to qualify for. The IRS is the final arbitrator on any tax resolution case; however, you significantly increase the situation by working with a seasoned tax attorney-CPA-IRS EA who specializes solely in working with tax resolution clients.

Should You Avoid Applying for an Offer in Compromise?

No, conducting a proper investigation is prudent to determine what would work best in your situation. It may be that the Offer In Compromise terms works better than a PPIA. To determine which tax relief option is best for your case, consult a tax attorney-CPA. They can use their experience and knowledge to engage the problem correctly and steer you to the best IRS resolution option that fits your needs and finances.

In addition, the IRS may deny your PPIA application and direct you to apply for an Offer In Compromise if the IRS believes an Offer In Compromise would be better for you.

Get Help Applying for a Partial Payment Installment Agreement

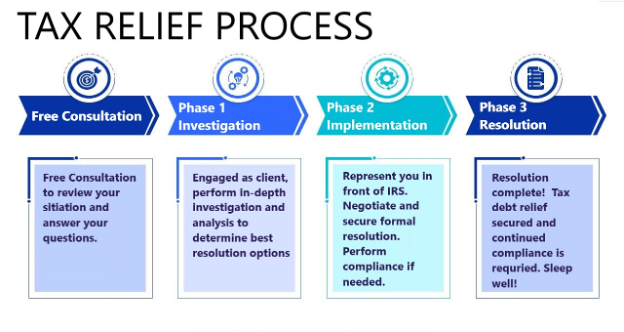

PPIAs are complicated to set up. For those in Port Saint Lucie, Fort Pierce, and Stuart looking for a tax attorney to help with a stressful tax situation, Harmon Tax Resolution, LLC can assist you throughout the process. At Harmon Tax Resolution, LLC, an experienced multi-licensed tax attorney-CPA-IRS EA will ensure you get the complete representation you deserve. Call Today so that you can sleep well Tonight.

Get Help Applying for a Partial Payment Installment Agreement with Trusted Representation at Your Side! Call 772-418-0949 for FREE CONSULTATION with Tax AttorneyCPA-EA, Will Harmon. Sleep well again at night!

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.