IRS Installment Agreements

Of the various options for taxpayers dealing with IRS tax liability issues, the IRS Regular Installment Agreement (IA) and the IRS Partial Pay Installment Agreement (PPIA) are the most used. To get a better understanding, let’s go over each plan type and its respective benefits and qualifications.

What Is an IRS Installment Agreement?

An IRS Installment Agreement (IA) is a monthly payment plan set up with the IRS to pay your outstanding tax balance. An IA is for use when you have sufficient income or assets to make payments to cover the total amount of the tax balance owed. There are several types of full payment plans, and depending upon your tax situation will determine which payment plan would work best for you. Full payment options include a short-term payment plan (paying in 180 days or less) or a long-term payment plan (installment agreement) (paying monthly), which in some cases could be as long as seven years (84 months). Most are generally set up for six years (72 months). Let’s start with the long-term payment plan.

Long-Term Payment Plans (Installment Agreement):

have specific tax balance stipulations. When you owe $50,000 or less in combined tax, penalties, and interest and have filed all required returns, you can simply get a full payment IA payment plan for six years (72 months) by requesting it. If you owe more than $50,000, the IRS will request that you complete either Form 433-A or B. With either of these forms, you must provide a complete financial listing of assets, liabilities, income, and expenses from which the IRS will ascertain what monthly disposable income you must use for payment.

Short-Term Payment Plan:

You owe less than $100,000 in combined tax, penalties, and interest. A short-term payment plan pays the total balance due in 180 days or less. This plan helps avoid incurring significant interest costs.

What’s the Longest Time I Can Request an IRS Installment Plan?

It is important to note that when it comes to IA, the IRS generally requires you to pay the entire tax liability within seven years (84 months) or the Collection Statute Expiration Date (CSED), whichever occurs first. CSED is ten years from the date the IRS assesses your tax amount. Ordinarily, only during the CSED period can the IRS enforce collections on an unpaid tax. When negotiating an IA with the IRS or any other resolution, knowing the CSED for any outstanding tax balance is critical.

How Do I Determine How Much I Should Offer to Pay the IRS on a Monthly Installment Plan?

Ensuring that the monthly payment amount is within your budget is the ideal way to make an IA offer to the IRS versus doing so by coming up with an amount strictly based on getting IRS approval. The latter way could backfire if the plan defaults, making it challenging to negotiate another plan with the IRS favorably. To avoid making a mispayment calculation, complete the applicable 433 forms thoroughly. The form’s function is to obtain an accurate financial determination of your monthly disposable income. It may be beneficial to speak with a tax professional regarding how to maximize the efficiency of this form whenever the IRS needs it for a resolution determination, such as installment plan types, Offers In Compromise, or Currently Not Collectible Status.

How Long Does it Take for IRS to Approve an Installment Agreement?

Ordinarily, obtaining an Installment Agreement approval can take up to two months. It could take longer if your tax bill is more than $100,000.

What Do You Need to Apply for a Payment Plan?

To do it online, you need to create an IRS account with ID.me, and for verification purposes, you will need photo identification.

If you apply for a direct debit payment plan, you will need your bank routing and account numbers.

If you recently filed your tax return or your return was examined but have not received a balance notice from the IRS, you will need the balance due shown on your return.

Are There Fees to Apply for an Installment Agreement?

Yes, you must pay setup fees: The setup fee for an installment agreement with IRS varies depending on your chosen plan. The IRS charges $225.00 for a non-direct debit installment agreement unless set up online through www.irs.gov. The cost is $149.00 for non-direct installment agreements and $107.00 for direct debit agreements applied through phone, mail, or in-person, and $31.00 if applied online. For non-direct debit installment agreements, a reduced $43.00 fee ($0.00 for direct debit agreements) applies if you have income at or below specific government poverty guidelines. If you qualify, you may apply by submitting Form 13844 (Application for Reduced User Fee for Installment Agreements).

What Should I Do if the IRS Denies My Installment Agreement?

Sometimes, the IRS does reject requests for Installment Agreements– if this happens to you, you have the right to appeal. To appeal, you must complete and submit Form 9423, Collection Appeals Request, within thirty days of the rejection notice.

Will the IRS Keep My Refund if I Have an Installment Agreement?

Unfortunately, the IRS will automatically apply any refund or overpayment against your tax balance. This is stipulated within the Installment Agreement. Even though any refunds or overpayments will reduce your balance, you must continue making the agreed-upon monthly payments until fully paid.

What Is a Partial Payment Installment Agreement?

When your current financial resources enable some payment towards the tax liability but not enough to cover the entire balance by the time the CSED expires, you may qualify for an IRS Partial Payment Installment Agreement (PPIA). When applying for this type of resolution, the IRS requires the completion of forms 433 A or B. From your financial data, the IRS determines your disposable income based on allowable local and national standards for expenses and what is available as equity in your assets. There are some exceptions in which you may qualify based on individual circumstances; therefore, seeking advice from a tax resolution expert may be helpful.

A PPIA is primarily a temporary payment plan that lasts between two and three years before the IRS requires you to provide updated financial information to determine whether to provide for a continuance. The IRS terminates the first agreement and then decides whether to reinstate the PPIA again based on your updated financial position. This process may occur again until the CSED is reached.

There are a couple of things to bear in mind. First, in either IA or PPIA, the interest and penalties continue to accrue while a tax balance exists. Second, the IRS has a right to protect its interest by filing a Federal Tax Lien toward the balance owed.

Generally, the IRS will not file a tax lien for amounts under $10,000 unless there is an imminent danger of their inability to collect due to other circumstances like bankruptcy, for example.

If your tax balance is $50,000 or greater, the IRS will automatically issue a Federal Tax Lien to you.

On the positive side, the CSED continues to run. Based on your situation, you may eventually qualify for other resolution options, such as an Offer in Compromise. It is important to note that if your financial situation changes to where you do not have disposable income to pay on the tax balance, you may qualify for what is known as Currently Not Collectible status.

- For more information, please read the recent blog posts:

What Are Streamlined Installment Agreements?

Streamlined Installment Agreements require you to pay the entire balance within six years or before the collection statute of limitations expires, whichever is sooner. You can avoid a tax lien if your balance is less than $50,000 or if you can pay the balance down to less than $50,000 before establishing the streamlined installment agreement.

If your unpaid balance is between $25,000 and $50,000, the IRS won’t file a tax lien if you allow the IRS to take installment agreement payments directly from your bank account or wages.

If your tax balance is $50,000 or greater, the IRS will automatically issue a Federal Tax Lien to you. If your balance is $50,000 or less and your CSED is greater than 84 months, you can still get the streamlined status (more on below) under an 84-month plan if you have an automatic direct debit or payroll deduction setup. If you do not choose either of these automatic payment options, the IRS may set up a federal tax lien against you.

Can the IRS Revoke My Installment Agreement?

The IRS can revoke any installment plan and give you a default status. A default status will put you back to the collection point you may have initially been in or could soon become into, such as tax liens, asset levies, and wage garnishments. You will most likely find yourself in IRS default status when:

- You miss payments.

- You do not file a tax return for the current year.

- You have unpaid taxes due.

- You provided inaccurate information during the IA process

- IRS, or as listed in PPIA, your financial position has changed, allowing the IRS to increase your payment amounts.

To get back in compliance, you must endure the rigorous process of renegotiating your PPIA or IA from a lesser position. In contrast, the IRS will renegotiate from a more stringent position due to the default.

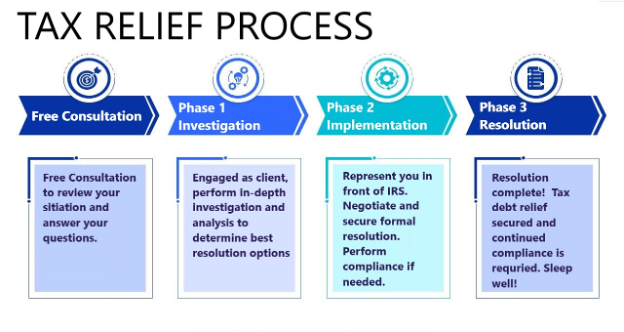

Get Help Applying for a Partial Payment Installment Agreement or Regular Installment Agreement with Trusted Representation at Your Side! Call 772-418-0949 for FREE CONSULTATION with Tax Attorney-CPA-EA, Will Harmon. Sleep well again at night!

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.