Dealing With IRS Unpaid Taxes and How to Resolve Them

Owing IRS taxes can cause much stress and financial difficulties, especially if you are unsure how to address it. What happens next? Will the IRS seize my property? Could I face criminal charges for unpaid taxes?

The harsh reality is that your situation will worsen if unpaid taxes remain unattended. The good news is there is always a solution to every tax problem. Even though the IRS has extensive collection enforcement capabilities, it also provides various resolution options that can be negotiated.

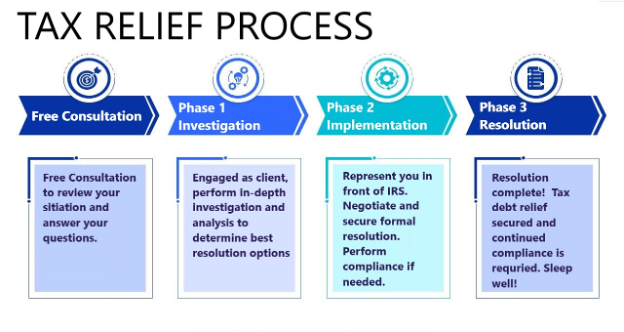

You don’t have to handle this stressful situation alone. Harmon Tax Resolution (HTR) can alleviate your concerns by guiding you toward the best available tax resolution and advocating on your behalf with the IRS. For a Free consultation, call Today at 772-418-0949 or complete the online inquiry form.

What Causes Unpaid Taxes?

Unpaid taxes can come about in several ways:

- Did not pay taxes as listed on your tax return filed.

- Additional taxes have come from changes made to your tax return from IRS Assessments.

- The IRS prepared a Substitute For Return (SFR), resulting in taxes owed.

- The IRS has assessed a tax against you, and you haven’t paid it yet.

An SFR results when you do not file your return and the IRS files one on your behalf based on 3rd party reports or the use of prior data to reconstruct.

How Does the IRS Address My Unpaid Taxes?

If an IRS assessment results in additional taxes being assessed, the IRS will send a notice indicating such. If you disagree with the assessed tax, you can appeal; however, you must do so within specific time frames to use certain appeal options. The IRS will send you collection notices if you don’t begin the appeals process.

What Happens If I am Unable To Pay Taxes Owed?

They apply penalties and interest toward the outstanding debt to incentivize taxpayers to pay taxes. If this does not work, the IRS may incorporate more drastic measures, such as making liens, garnishing wages, seizing assets, preventing passport issuance or use, and even foreclosing on your property. Fortunately, there are various tax resolution options you may be able to deploy; depending on your circumstances, you may be eligible for several IRS tax resolution options.

What Processes Does the IRS Use for Unpaid Taxes?

IRS processes are progressive. It begins when the IRS starts by attaching penalties and interest as incentives to get you to pay. Penalty amounts are typically determined based on how large the tax debt is. Suppose payment at this penalty phase does not occur. In that case, the IRS will now take actions to secure payment, such as initiating tax liens, garnishments, and levies and facilitating asset seizures and foreclosures. Here are some of the penalties and collection actions taken by the IRS:

- Failure-to-file penalty — If you file a tax return late or not at all, the IRS will issue you this penalty, which is penalized monthly at 5% of the tax due. This penalty maxes out at 25%.

- Failure-to-pay — You incur this penalty if you do not pay the tax due from your tax return. It’s charged monthly at 1% of the tax due and maxes at 25%.

- Interest — the entire balance of tax and penalties is subject to statutory interest application. Interest compounds.

- Tax Liens — The IRS obtains legal rights to any assets you own and acquire while the tax balance is present.

- Tax Levies — The IRS can garnish income sources, levy bank accounts, seize assets, and foreclose. The IRS can even have your passport revoked or denied.

The IRS is the most powerful debt collection agency in the USA. It is a much better option to obtain a workable tax resolution than for you to be on the receiving end of a lien, levy, garnishment, seizure, or foreclosure.

Does The IRS Become More Aggressive Based on How Much You Owe?

The answer is yes. The IRS will employ measures for any tax debt; however, it will focus more resources and utilize harsher tactics for those who owe more. Here is a breakdown of what to expect based on how much you owe:

When Your IRS Tax Debt Is Less than $10,000

If you owe less than $10,000, the IRS is not as aggressive and most likely will not place a lien on you. You most likely will have the option to set up a monthly installment plan to pay off the debt over time.

When Your IRS Tax Debt Is Between $10,00 and Less Than $50,000

When your tax debt is between $10,000 and $50,000, you are subject to liens and future collection efforts. Resolution at this level can be as simple as setting up an installment agreement. Generally, you can avoid financial disclosure to the IRS by setting up a direct debit installment agreement or making a set payroll deduction. To forgo this option may mean providing financial information to the IRS and seeking acceptance.

When Your IRS Tax Debt Is Greater Than $50,000

At this level, you have the IRS’s attention. The IRS will generally require full financial disclosure before accepting payment arrangements. You now are at greater risk of being subject to severe collection activities, including revoking your passport. Action is needed on your part.

How Should I Handle Unpaid Taxes?

Take a proactive approach. If you have to deal with the IRS, it generally goes better if you are reaching out to them before they have to reach out to you. Establishing compliance to negotiate a resolution with the IRS would be best. Compliance means that you have no unfiled returns. This generally means you must have filed tax returns for the last six years.

Determine the Total Amount Owed

Your starting point is to know your balance and the details, such as when the taxes were assessed, along with penalty amounts and types.

Understand What Tax Resolution Options Are Available.

Knowing your tax balance and its details, you can determine which tax resolution option will fit your situation best. It can be very challenging unless you know IRS processes and procedures. It is recommended to work with a multi-licensed IRS tax resolution specialist.

What IRS Tax Resolution Options Available?

There is a solution to every tax situation, depending on your circumstances. Here are some of the available options:

Have Your Tax Liability Written Off by the IRS

Yes, the IRS does settle many tax cases for significantly less than the amount owed. However, beware of those firms who make this claim upfront without thoroughly investigating the pertinent facts. Usually, you can only have your tax liability lessened or written off if you qualify for:

- Currently Not Collectible status

- Due to financial hardship status, tax payments cannot be made.

- Partial Pay Installment Plan

- Making lower monthly payments at the level of affordability within IRS standards.

- Offer in Compromise

- Settling the tax debt for less than the balance owed. You have to establish that you cannot pay the debt off before the Collection Statute of the Expiration Date expires.

- Seek Innocent Spouse Relief

- There could be circumstances where the tax debt is due to actions taken by our spouse or ex-spouse. There are several types of innocent spouse relief. Generally, you must establish that you did not know the cause of the tax debt or were under duress from taking action.

- Request Penalty Abatement

- You may qualify to have some penalties reduced through penalty abatement, regardless of whether you are eligible for other options. The IRS does not come out and offer this form of relief; therefore, you must request it.

Get Trusted Professional Tax Help With Your Unpaid Taxes

Regardless of why you have unpaid taxes, we can help. The tax attorney CPA – EA Will Harmon of HTR has significant successful experience assisting taxpayers with delinquent taxes, unfiled tax returns, improper tax assessments, and many other tax issues. Do you Need immediate help? Talk to Will. Call Today for a free consultation at 772-418-0949 or complete the online inquiry form. Gain control again!