Port St. Lucie Wage Garnishment Attorney

Get Help on Your IRS Garnishment from an Experienced CPA-Lawyer

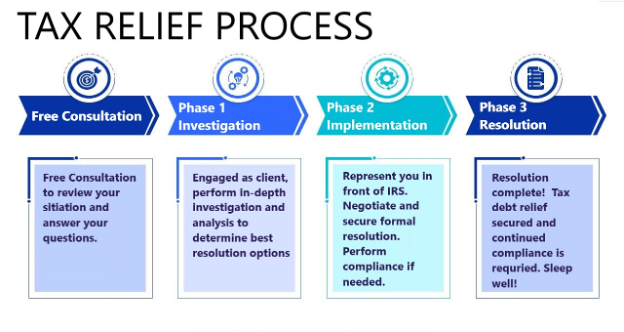

If you cannot repay your debt to the IRS, you must find a solution before your wages are garnished. Garnishments could eat away at your paycheck that is getting you by, making it even harder for you to contemplate a plan to resolve your tax debt. However, you do have options and rights as a taxpayer.

While avoiding wage garnishment is the best thing you can do for yourself, there is still a way to halt the process if the garnishment has begun. Harmon Tax Resolution, LLC’s wage garnishment lawyer, has helped clients avoid and even end wage garnishment activities.

Schedule a free initial consultation with our wage garnishment lawyers at Harmon Tax Resolution, LLC to get started. Call 772-418-0949 to let us help you settle your wage garnishment concerns in Stuart and Fort Pierce.

What Is a Wage Garnishment?

The IRS has the right to garnish your employment wages if you owe the IRS tax debt. This means the IRS can take money from your paycheck each pay period to satisfy the debt you owe them, and they do not need to obtain a court judgment (which creditors need) before garnishing your wages. The amount of money the IRS may garnish from your paycheck is determined by your dependency elections.

Fortunately, wage garnishment will not happen without your knowledge; you will first receive notice before this happens, giving you time to explore your options with a lawyer. The notice will specify your outstanding balance (itemizing the tax debt, penalties, and interest) and the due date by which you must pay that balance..

When Do I Need To Respond to an IRS Wage Garnishment Notice?

If you have received a notice from the IRS about a wage garnishment action against you, the time to act is now. The sooner you implement a plan for halting wage garnishment, the better your chances of successfully avoiding it.

As a skilled tax attorney, CPA, and EA, William Harmon can help you determine the right course of action to handle your unique case. Whether the best option for you is proposing an Offer in Compromise, an installment plan, or challenging the tax debt amount, there is always a way to prevent the IRS from garnishing your wages.

Let Harmon Tax Resolution, LLC Help

Attorney-CPA-EA Will Harmon can help you find a solution to your tax issue and stop an impending wage garnishment. We offer free initial consultations, where we will discuss your situation with you in more detail and explore your available options. Attorney-CPA-EA Will Harmon knows what it takes to get you back to a better financial standing.

Contact Harmon Tax Resolution, LLC for a free consultation to get started immediately. Let’s act now to protect your finances. Call 772-418-0949 to speak with a wage garnishment attorney near you.